Another positive development in the self-exclusion stakes came this week, as Halifax joined other UK banks in allowing customers to block any payments to casinos and bookies.

The list of other financial institutions which now allow freezes on gambling-related transactions using their bank cards includes MBNA, HSBC, Barclays, Lloyds and Bank of Scotland.

Although Halifax’s measure does allow customers to ‘unfreeze’ payments to bookies and casinos at any time, this does come with a 48-hour time window. We hope this will stop the most impulsive kinds of behaviour from problem gamblers.

But surely the longer exclusion timeframes (6 months – 5 years) allowed by Gamstop is going to be more effective for customers who are in a low point in their life and have the urge to use gambling as an escape.

It’s not clear whether this move extends to Halifax credit cards or just debit cards. Presumably, it covers both kinds of cards. But with the Lib Dems joining the Tories and Labour in wanting a total credit card ban on gambling, it seems that in 2020, this won’t be an option anyway, whichever way the upcoming election plays out.

It will be interesting to see how whoever is in government tackles the loophole of punters topping up PayPal accounts with credit cards and then using the eWallet to bet online. Perhaps the politicians aren’t aware of this?

A slightly more comprehensive solution to self-exclusion comes from the folks at thePOGG.com. Over the autumn they have been rolling out an app for Android, iOS, Windows and Fire devices which stops users from accessing over 6700 gambling sites. That includes all those dodgy Eastern European and Caribbean operators who don’t have UKGC licences.

The Bet Blocker app lets the user set their own self-exclusion time period and has proved popular so far, with over 40,000 downloads across all platforms. It’s a free tool too, which is nice.

I am going to test it out next month and will be interested to see if works across all browsers. As the team behind it says, there is no magic bullet to stopping gambling-addictive behaviour, and if punters are determined enough, they will find a way.

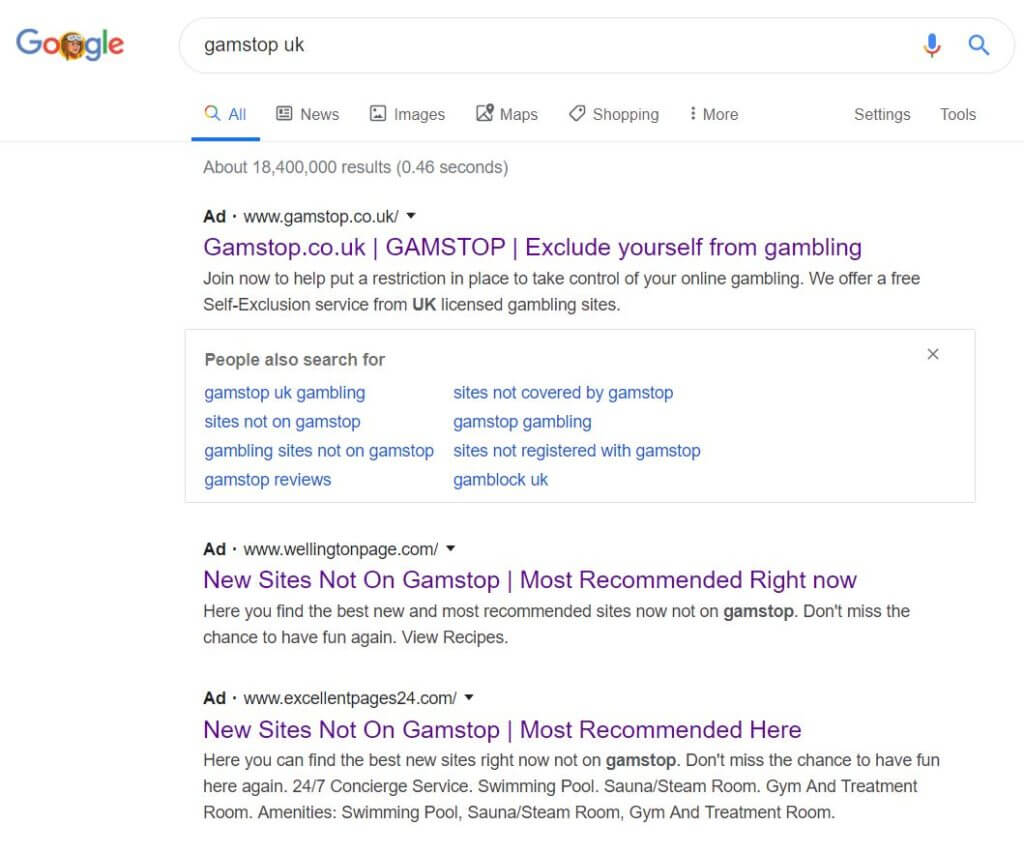

Already, some gambling affiliates are bidding on “Gamstop” searches on Google and are presenting adverts claiming to show new casino sites which aren’t on the system – as you can see in the screenshot below.

But when you listen to politicians, banks and the gambling companies themselves, it’s clear which way the wind is blowing. Self-exclusion will likely be a much more watertight process in a year’s time than it is now, with fewer opportunities to gamble for those who have decided to put a stop to it.

And if the large bookie chains follow through with their threat to close down thousands of outlets, there could even be less opportunity to walk in off the street and gamble with cash.

The challenge will be finding the right balance between helping problem gamblers take a break from the hobby while allowing responsible players to get their accounts funded with the minimum of fuss. If the authorities mess this process up, those dodgy offshore bookies and casinos could reap most of the rewards.